Ace Info About How To Sell A Stock Short

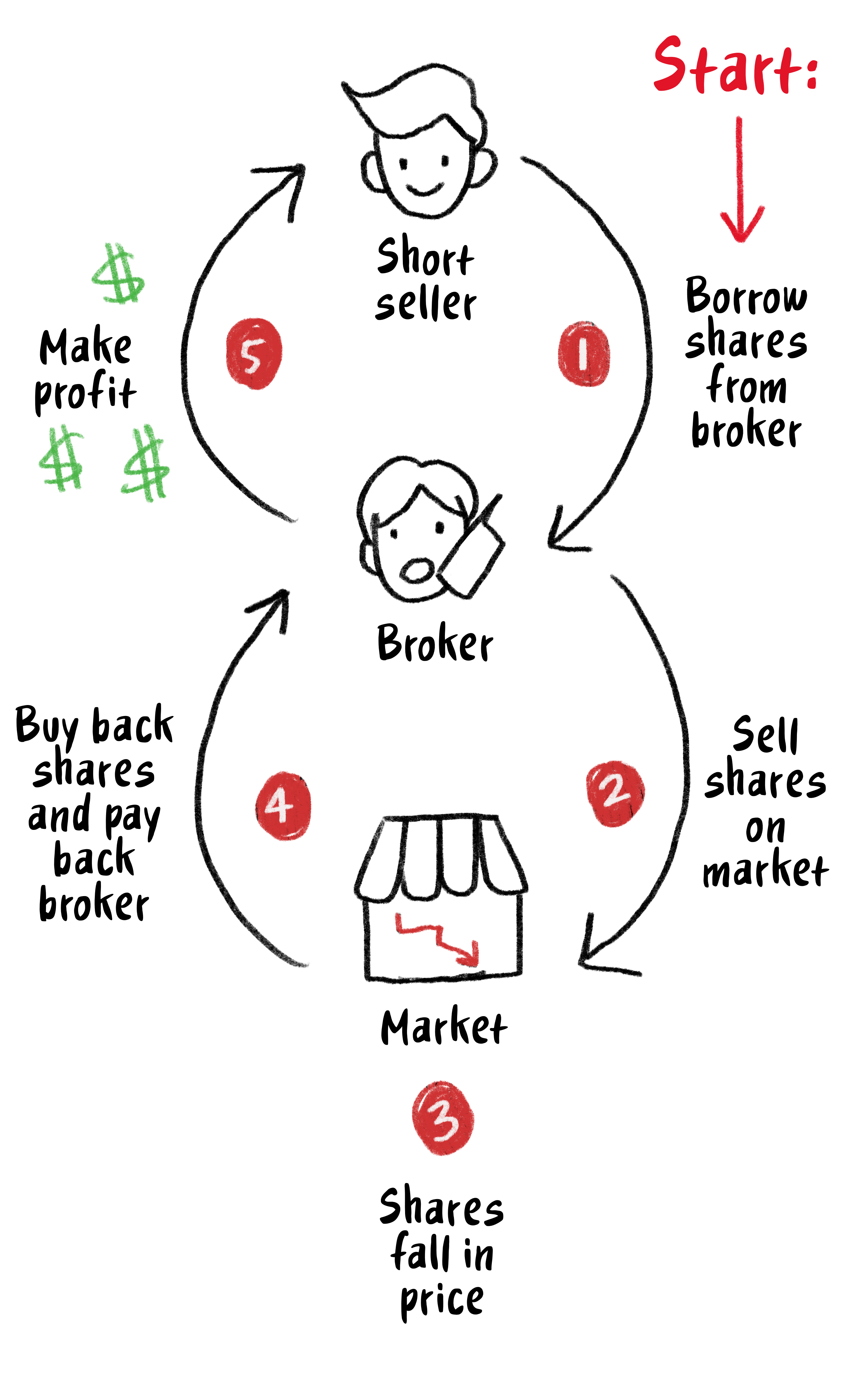

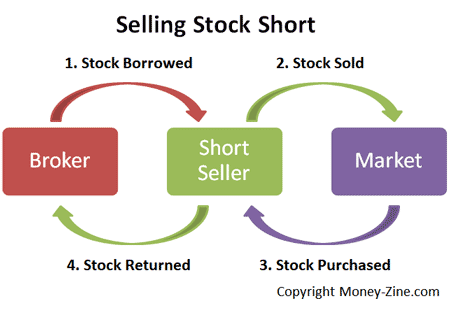

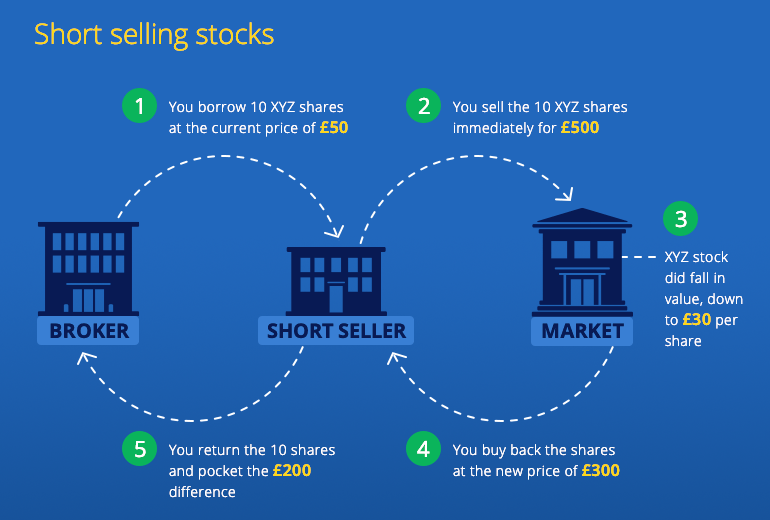

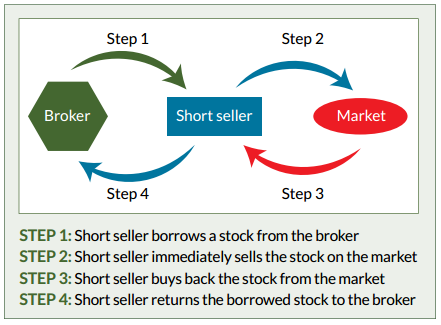

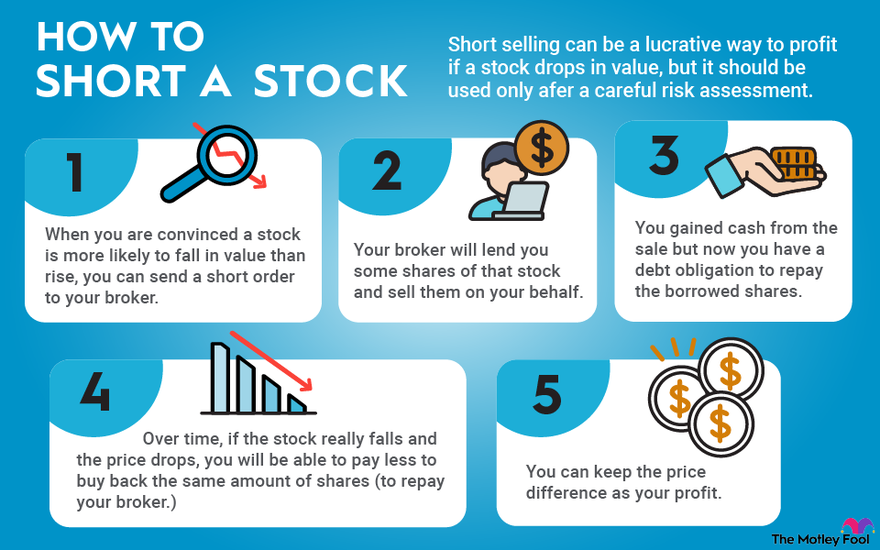

The process of short selling is relatively simple once you've identified the stock you want to short.

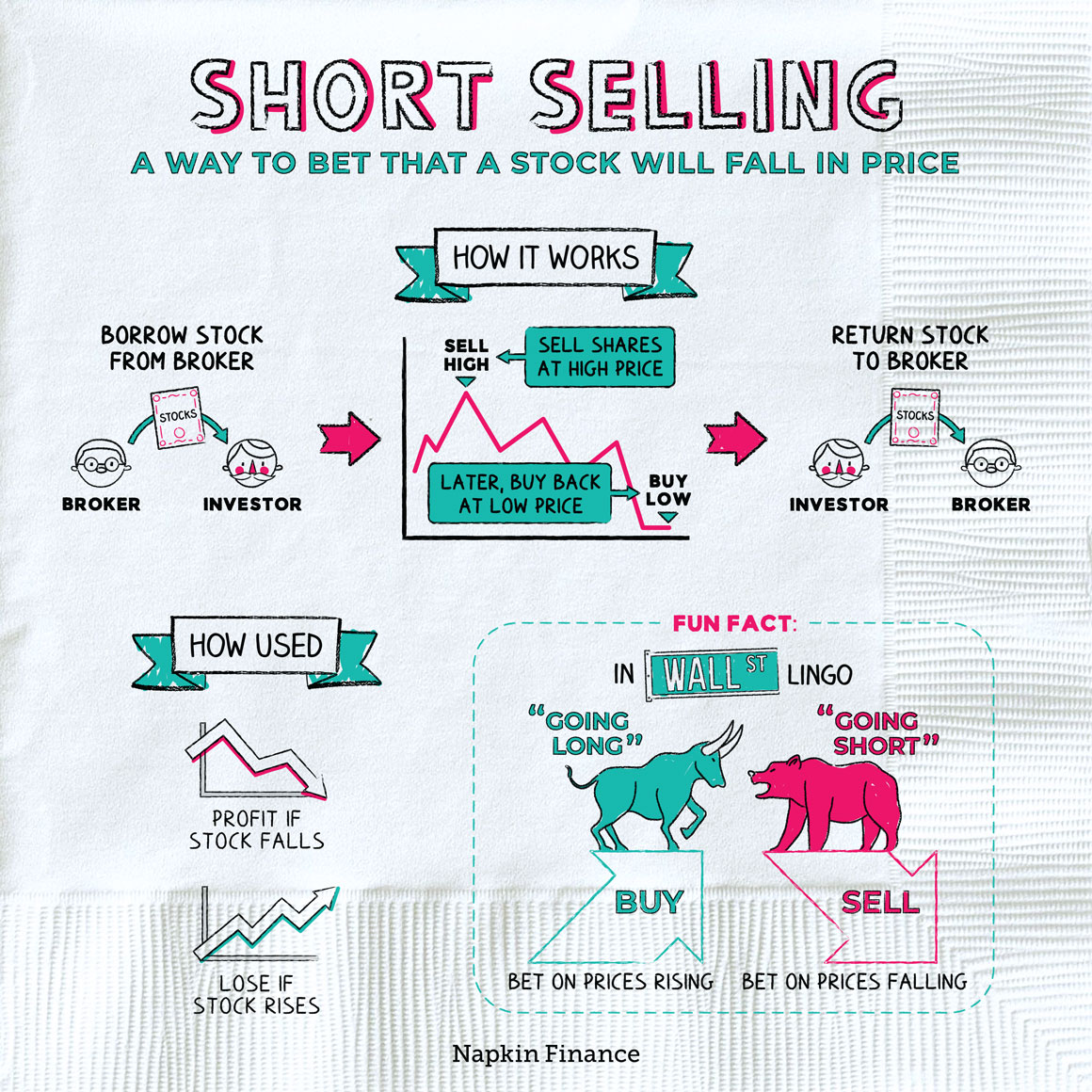

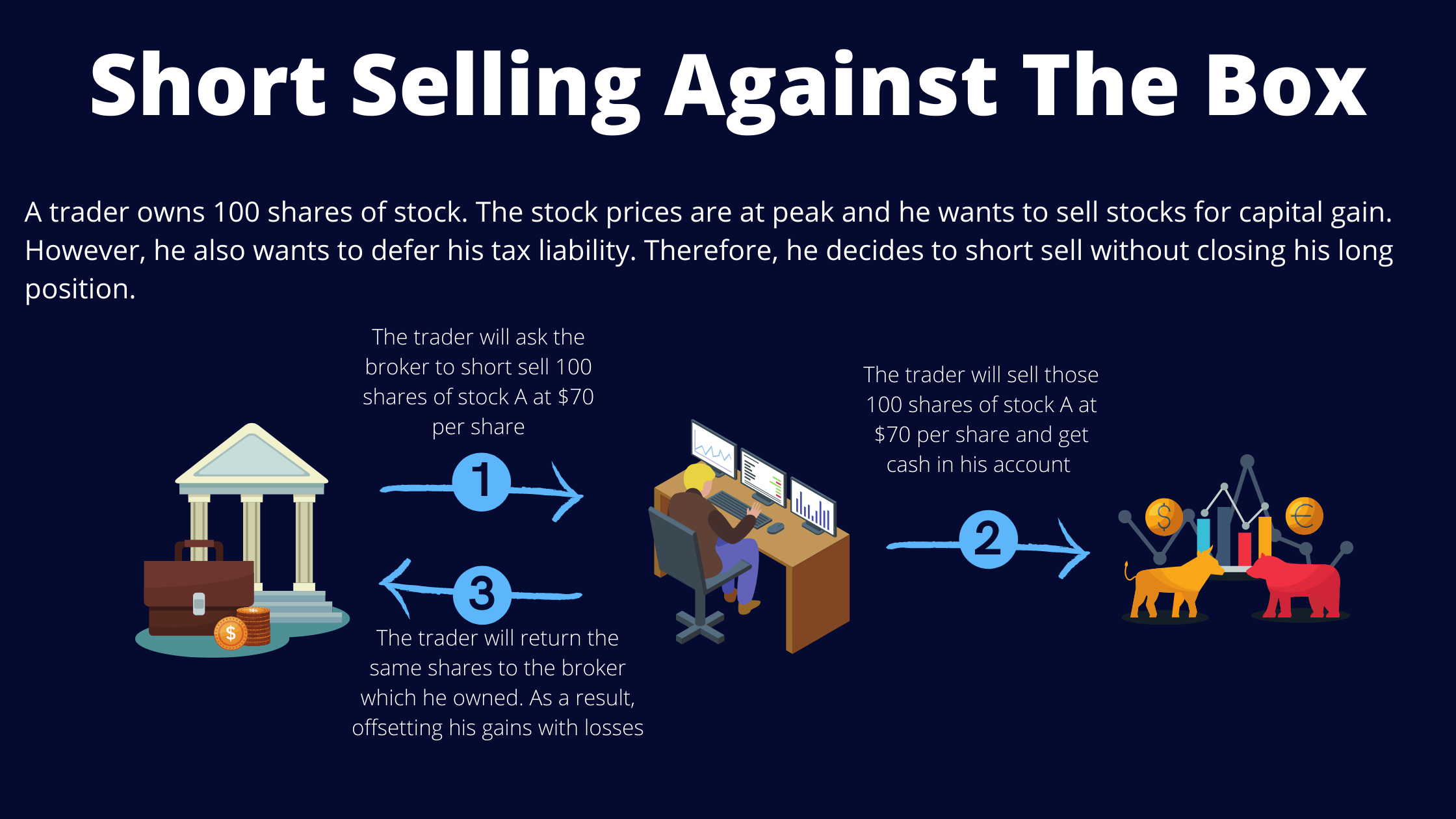

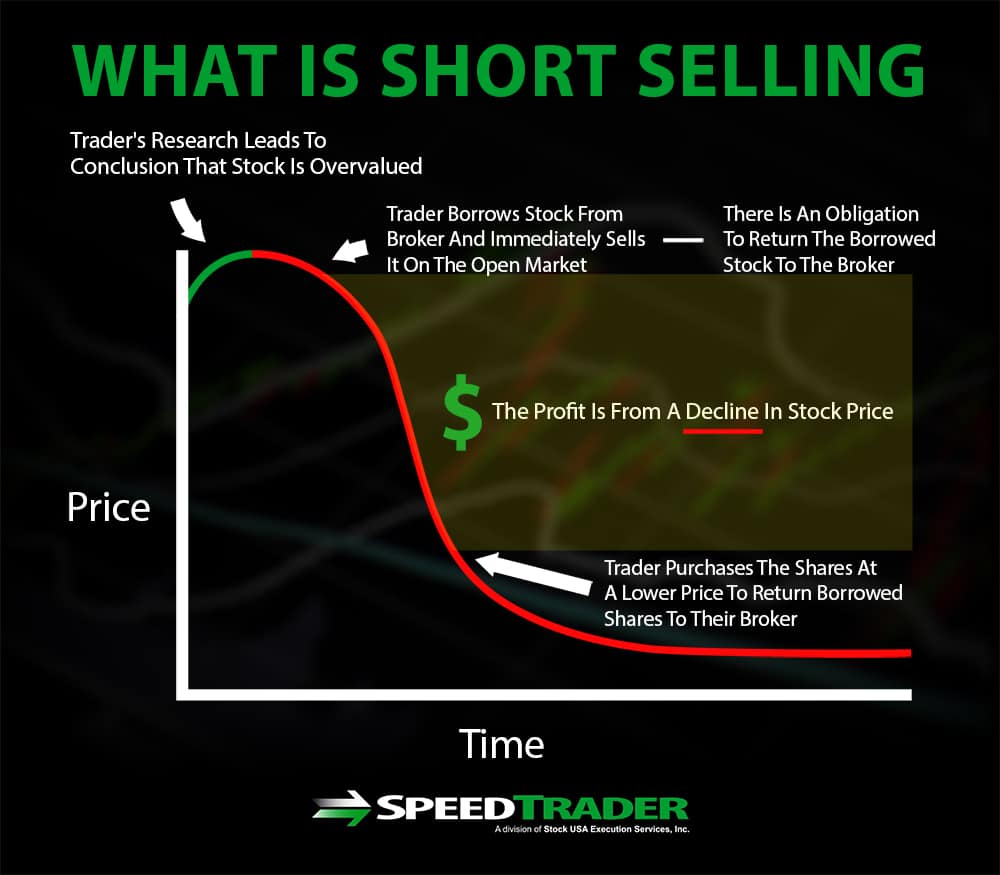

How to sell a stock short. Understanding how shorting works is key for your desired outcome. Short sellers are wagering that the stock they are short selling will drop in price. Most stock market investing is known as “going long”—or buying a stock.

Choose the stock you believe will decline in value. Identify the stock that you want to. Short sellers must meet the.

At the end of june 2021, the share prices are csl at $285,. To sell a stock short, you borrow the shares from your broker, then sell the shares and hold the money and wait for the stock to fall. Now wills has put some prices around our stock picks.

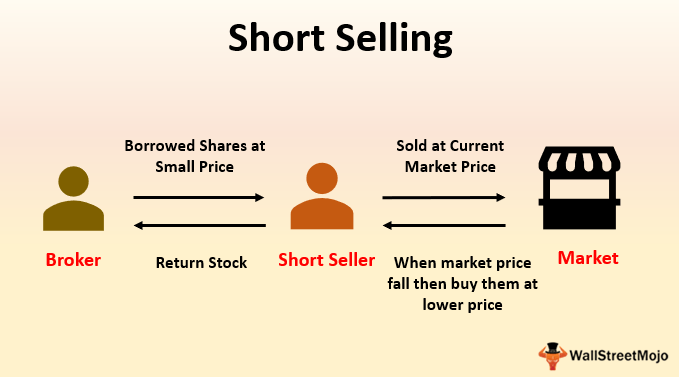

In short selling, investors borrow stocks, speculating future price drops, and sell them to interested buyers at high market prices. Short selling is an advanced trading strategy that flips the conventional idea of investing on its head. Short selling is a method that enables market participants to sell securities without owning the underlying security.

Select the ticker symbol of the stock you want to bet against. These are the six steps to sell a stock short: If the stock does drop after selling, the short seller buys it back at a lower price and returns it to the lender.

Log into your brokerage account or trading software. When you want to sell short, in order to get the shares to sell, you borrow them from your broker. Stock short selling provides information including stock short selling ratio, short selling turnover, turnover, same industry top 5 short selling ratio, historical short selling.

/Term-Definitions_shortselling_FINAL-781cdf1e97ab4425939eb109b666a004.png)